The restart of my restart of my restart of my restart.

I’ve had so many attempts at weight loss over the years. I usually fall off the wagon after a month… sometimes earlier. August 4 2023 I started again. This time I’m adding better financial habits to my goal list along with weight loss/fitness.

I’ve been digging myself out of credit card consumer debt, but had a bad habit of spending everything I had paid off. In early August I started to tighten the purse strings. I am only buying things I need and have quit browsing physical and online stores. That includes thrift stores and antique shops and I do LOVE thrifting, but I always get things I don’t need – like more sewing supplies. I have an entire closet full of sewing supplies. It’s packed full. I’m not buying any more sewing stuff until I get through the piles of fabric I already have.

September I ended up at the thrift store looking for a new harness for Oliver – my big golden retriever X puppy. He’s a puller and ended up tearing right through his last one. I didn’t find a harness that would fit him there. I did however find a full set of winter dog boots which I actually would have needed for an awesome price. That was an okay purchase, but guess what wasn’t. The roll of elastic I bought – FOR SEWING! It WAS a fantastic price, and sure I’ll probably need it one day, but that wasn’t the point of this. I’m not supposed to be randomly buying stuff I don’t have an immediate need for. This was a warning for me – to stay out of thrift stores. I can’t be trusted! I discovered pressure casting posts, an item used in pen making. It’s quite expensive and I’m not buying it this year. I heard a quote but can’t remember who it was from – Ramsey? “If you can’t pay it off in a month, you can’t afford it”. That stings, but I agree. So no pressure pot. Not yet. Saving for one also gives me time to evaluate if I really want it. Making impulsive purchases and then never using the item is a bad habit I have had in the past. For example, I bought the things to make shoes with, maybe a year ago. Guess who has never made shoes – ME! I still hope to one day, but for now, it was something I shouldn’t have purchased.

As for weight and fitness, this time my spouse is also on board. He really wants to lose weight too. We’ve set a pact to be in the gym three times a week on set days. That started on the first of September and so far we are sticking to it. We don’t have a set thing we need to accomplish in the gym, right now we just have to be in there. Even stretching is acceptable, just be in there, getting a routine established and habit formed. Right now I’m doing about a 15-minute workout and nothing too strenuous, just getting used to working out again.

I’ve set a goal for myself to be able to do a push-up in a year. The real on your toes sort of push-up. I’ve never been able to do them, even at my most fit. That was probably because I always preferred jogging to weights. I’ve always wondered how does one work their way up to being able to do a push-up?

This might work. I’ve started with wall push-ups. I thought that sounded like weak sauce, but it turns out that doing 3 sets of 50 is actually pretty hard (for me). I’m not even there yet! I had to take a break after 40. I’m sticking with it. I got my 150 in and will be keeping track of how many I can do until I need to stop.

I’m calorie counting again. The goal is 1800 calories a day. I’ll stay with that and keep it up if it’s working well for me. My spouse is calorie counting too. We’ve started cooking for ourselves and that is going to work out really well for both of us. He’s never really liked veggie-heavy dishes and the carb-heavy dishes he likes I tend to overeat. This way we can both eat healthier for ourselves.

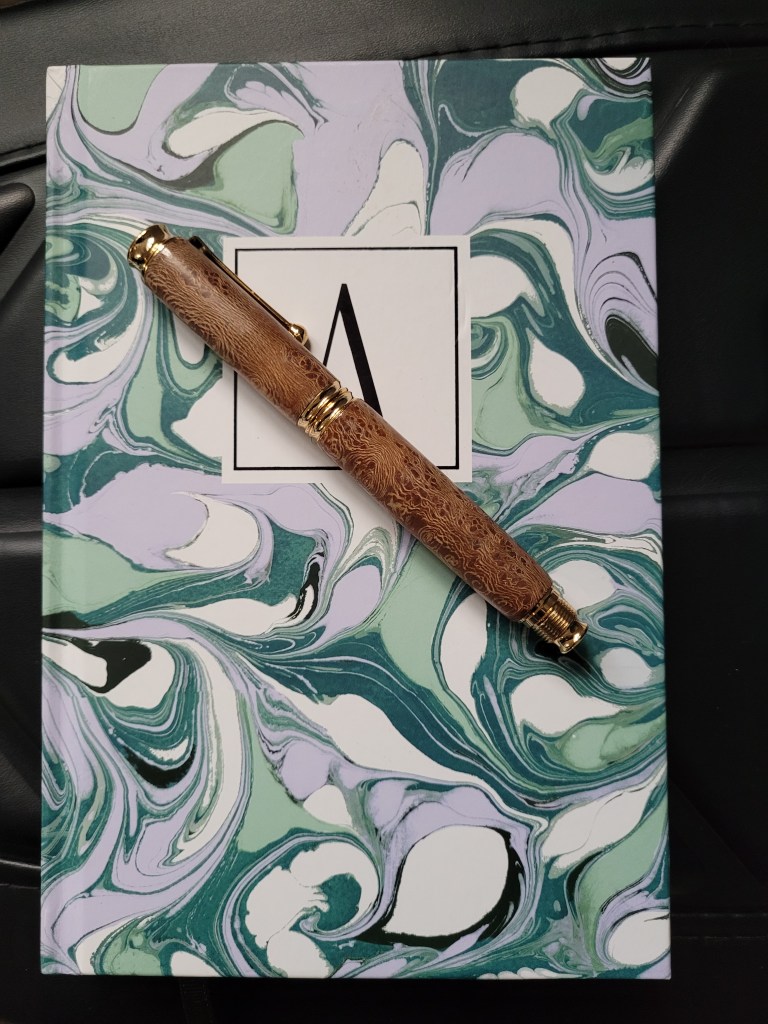

I’ve started a tracking journal and every month I update my weight and how much I’m in a financial debt hole. I realized when doing the September update that I only wrote down approximate numbers instead of the actual numbers in August. I was excited to see if I had made any progress. That will have to wait for October. I will post September’s stats as the starting point.

Weight: 178lbs

Debt: -$21100

Wall pushups without stopping: 40

Cheers to improved numbers in October!